到更高的高度

Family Office Setup in Singapore

家庭办公室在新加坡

这是什么?

Family Office Setup in Singapore has become a top priority for many high-net-worth families looking to manage and grow their private wealth. A family office provides a structured way to handle investments, succession planning, and wealth transfer across generations. It ensures families have professional oversight of their assets while safeguarding their legacy.

Singapore is now recognised as Asia’s leading destination for family office setup. The city-state offers a stable political and economic environment, a transparent tax and regulatory regime, and strong legal protections—making it a trusted hub for wealth management. Families also benefit from Singapore’s world-class financial services ecosystem, global connectivity, and government support for investment structures.

Choosing to establish a family office in Singapore not only provides efficiency and control, but also ensures long-term stability in managing wealth across generations.

提高专业精神的家庭办公室的专业人员在新加坡,增强积极的溢出效应的新加坡经济,MAS已经更新的条件,上述计划(现称为 S13O方案 和 S13U方案 分别)。

这些变化生效 18April2022 并将以下修改:

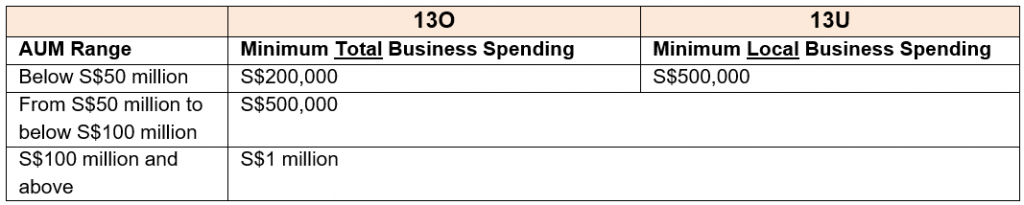

在业务开支的要求,应当指出的是,费用应当涉及的操作活动(而不是活动提供资金)的基金。 典型的支出包括,但不限于薪酬、管理费、税务咨询的费用和操作费用。 最低业务支出是由一个层次的框架如下:

资金的做更新的情况适用?

豁免的基金管理公司("联合会")负责管理资产,或代表其家庭(ies)

是一个免除FMC公司必须在豁免要求,以保持一个资本市场服务("CMS")许可进行活动的监管下的证券和期货法案》。

家庭办公室通常可依靠的自动豁免提供用于公司管理的资金用于它们的相关企业根据第5(1)(b)的第二个计划来证券及期货事务监察(许可和进行业务)条例》。

完全拥有或控制的同一家庭的成员(ies)。

根据该准则,"家人"包括直系后代从一个祖先一起(i)配偶和前配偶,以及(二)通过的和继子女.

Family Office Setup in Singapore

Planning to establish a family office in Singapore? Our specialists provide end-to-end guidance on structuring, compliance, and wealth management strategies. Build a solid foundation to safeguard your family’s assets and ensure long-term growth.