To Greater Heights

Family Office Setup in Singapore

Family Offices in Singapore

What is it?

Family Office Setup in Singapore has become a top priority for many high-net-worth families looking to manage and grow their private wealth. A family office provides a structured way to handle investments, succession planning, and wealth transfer across generations. It ensures families have professional oversight of their assets while safeguarding their legacy.

Singapore is now recognised as Asia’s leading destination for family office setup. The city-state offers a stable political and economic environment, a transparent tax and regulatory regime, and strong legal protections—making it a trusted hub for wealth management. Families also benefit from Singapore’s world-class financial services ecosystem, global connectivity, and government support for investment structures.

Choosing to establish a family office in Singapore not only provides efficiency and control, but also ensures long-term stability in managing wealth across generations.

To improve the professionalism of family office professionals in Singapore, and to enhance the positive spillovers to the Singapore economy, MAS has updated the conditions for the above schemes (now known as the S13O Scheme and S13U Scheme respectively).

These changes come into effect on 18 April 2022 and incorporate the following changes:

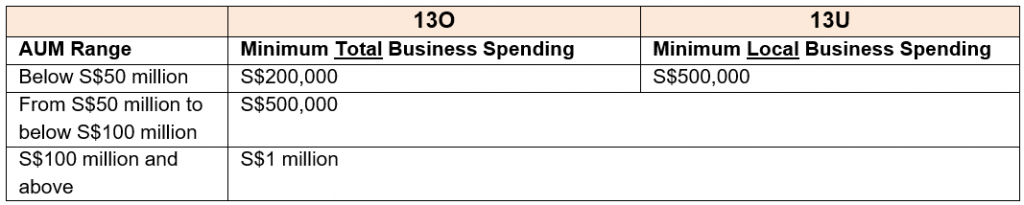

On the business spending requirement, it should be noted that expenses incurred should relate to the operating activities (as opposed to financing activities) of the fund. Typical expenditure includes, but are not limited to, remuneration, management fees, tax advisory fees, and operating costs. The minimum business spending is governed by a tiered framework set out below:

Which Funds do the Updated Conditions Apply To?

An exempt fund management company ("FMC") which manages assets for or on behalf of the family(ies)

To be an exempt FMC, a company must be exempted from the requirement to hold a Capital Markets Services ("CMS") licence to conduct activities regulated under the Securities and Futures Act.

Family offices can generally rely on the automatic exemption provided for corporations which manage funds for their related corporations under paragraph 5(1)(b) of the Second Schedule to the Securities and Futures (Licensing and Conduct of Business) Regulations.

Wholly owned or controlled by members of the same family(ies).

Under the Guidelines, "family" includes lineal descendants from a single ancestor, together with (i) spouses and ex- spouses, and (ii) adopted and stepchildren.

Family Office Setup in Singapore

Planning to establish a family office in Singapore? Our specialists provide end-to-end guidance on structuring, compliance, and wealth management strategies. Build a solid foundation to safeguard your family’s assets and ensure long-term growth.